We’ve already had an incredible record setting streak for food stamp usage. Now we can add high unemployment to the mix. The US economy just posted its 54th straight month at which unemployment was north of 7.5%.

This has never happened before. And the worst part is that unemployment is in fact much worse than this indicates. Indeed, the Feds implement multiple gimmicks to maneuver the unemployment number down. As I’ve told Private Wealth Advisory subscribers, the most nefarious is simply not counting those who haven’t looked for a job recently as unemployed.

BOOM! Suddenly a lot of the people who are in fact unemployed don’t count and the unemployment rate drops. After all, one cannot help but wonder how one in five US households is on food stamps, while unemployment is down near 7.5%.

A much better measure of unemployment which I’ve shared with Private Wealth Advisory subscribers, is U6 unemployment, which measures those unemployed plus those who are unemployed and have looked for work in the last 12 months and those who are working part-time for economic reasons.

When you use this measurement, the unemployment rate is closer to 14.3%.

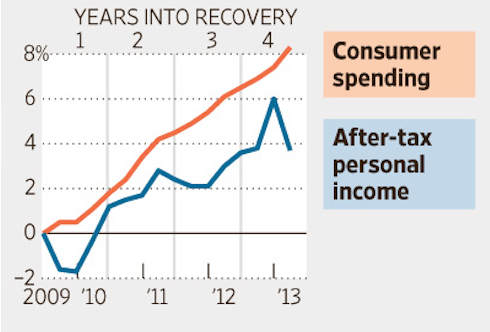

Against this backdrop of weak employment analysts continue to believe that the US economy will pick up in the second half of 2013. This is absolutely impossible. Weak employment means lower incomes. Lower incomes means lower consumer spending. Lower consumer spending means lower economic growth.

I warned Private Wealth Advisory subscribers in our most recent issue that the stock market was on borrowed time. The markets tend to stage summer rallies into the Fourth of July weekend, but with interest rates rising and the bond bubble beginning to burst, things are going to get much worse in a hurry.

This could easily become truly catastrophic. The world is in a massive debt bubble and the Central banks are now officially losing control. The stage is now set for a collapse that could make 2008 look like a joke.

If you are not preparing in advance for this, the time to get started is NOW.

For more market insights and commentary, visit us at:

www.gainspainscapital.com

No comments:

Post a Comment